Multi-Agent System

AI Intelligence Pipeline.

A three-stage system for search, reasoning, and probability calibration—powered by frontier and open-weight models working in concert.

Hound Agent

Search / OSINT / Fact Graph

→ Targeted Retrieval & Triage — Fast pass through Gemini 2.5 Flash

→ Claim Extraction & Normalization — Source standardization

→ Evidence Scoring — Weight each claim by confidence

→ Evidence Graph — Structured data model construction

Primary Model:

Claude 3.5 Sonnet

Shepherd Agent

Reasoning → Raw Probability (p)

→ Feature Engineering — Extract signals from Evidence Graph

→ Probabilistic Modeling — Ensemble approach for robustness

→ Human-Readable Rationale — Explainable outputs generated

Models:

Claude 3.5 Sonnet

DeepSeek V3.1-Think

⚠ Divergence Check: Δ threshold triggers dispute review

Kernel

p̂ Calibration & Meta-Aggregation

→ Cohorting — Group similar prediction types

→ Calibration Mapping — Isotonic or Platt calibration + QRA ensemble

→ Confidence Intervals — Uncertainty quantification

→ Online Reliability Monitoring — Continuous validation loop

→ Emit to Downstream — Final calibrated outputs delivered

Models:

Llama 3.1 405B

Qwen 2.5-72B

✓ Open-weight models keep frontier models clean & reduce cost

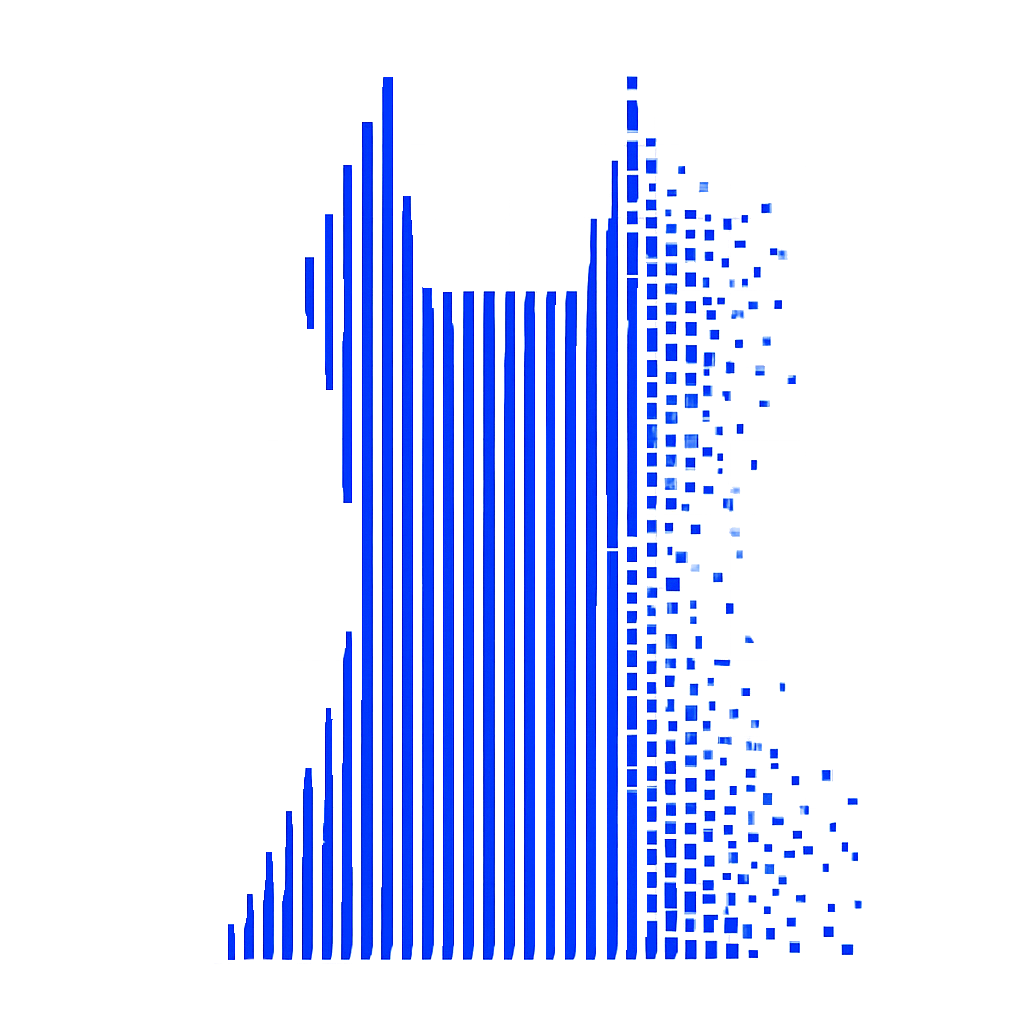

Misprice = Alpha

When Watchdog odds diverge from Polymarket prices — a misprice emerges. That gap is where traders find alpha.

Watchdog Odds

Crowd Odds

α-zone

Intel doesn't just predict. It measures disagreement between logic and sentiment.

ROADMAP

Watchdog Intel

- ▸Increase update frequency and market coverage

- ▸Add more domains to the benchmark

- ▸Release Model Chat — live reasoning feed of agents

- ▸Experiment with new LLM mixes and weighting strategies to create a live communication between different agents for a consensus

- ▸Polymarket trading competition between agents

Terminal

- ▸Integrate live news feed

- ▸Add on-chain insider activity analytics

- ▸Unlock Trading Mode — trade directly in the terminal with charts & filters, limited TP/SL orders

- ▸Deploy a Telegram Bot for trading and live misprice alerts